When retail traders look at a chart, they often see noise.

When hedge funds look at a chart, they see opportunity.

The difference isn’t luck it’s structure, timing, and rules.

At Omega AI, we teach traders how to think like institutions to read liquidity, price zones, and wave structure before the move happens.

In this post, we’ll walk through The 5 Rules of a Perfect Chart Setup,

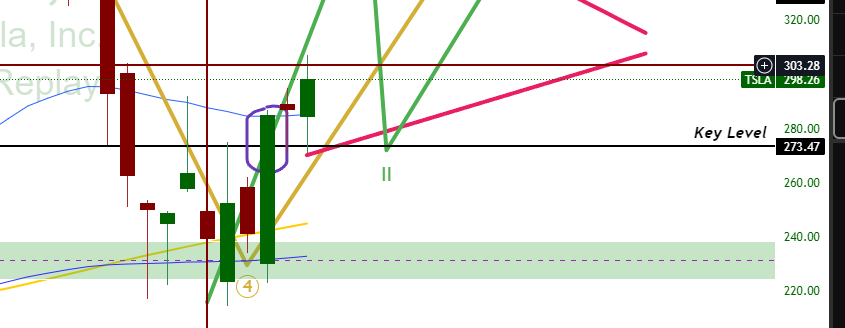

the same framework that caught the Tesla bottom months in advance and continues to guide our members every week.

Rule 1: Wait for the Discount

Smart money never buys the hype.

They wait for fear and for price to hit their buy zones.

“We don’t buy Tesla at $450 because we like the company.

We buy it at $235 because the chart told us to.”

Buying at discount levels allows room for error, protects capital, and builds confidence in scaling up when the trend confirms.

Rule 2: Respect the Buy Zone

The buy zone isn’t random it’s where hedge funds quietly accumulate.

It’s confirmed with a green weekly close showing strength off key liquidity levels.

At Omega AI, we map these zones automatically for you so you know where smart money steps in.

Rule 3: Identify the Key Level

Once you’ve entered your first position, the key level becomes your gatekeeper.

If price breaks and retests this level successfully, it’s a strong signal that the next wave is forming.

In our Tesla example, the $TSLA chart broke and retested perfectly

a textbook A++ reaction that preceded months of upside.

Rule 4: Watch the Resistance

Every rally faces resistance.

But not every resistance means reversal.

Look for one of two things:

A rejection followed by a higher low

Or a clean break confirming continuation

This step separates “lucky traders” from those who plan with precision.

Rule 5: The Higher Low

The higher low is where confidence becomes conviction.

It’s where liquidity resets, sellers exhaust, and hedge funds reload for the next expansion phase.

This is the final confirmation before full allocation.

In $TSLA, this higher low aligned with our buy zone

that’s why we called the bottom months before it ran.

Bonus: The Proof

We don’t ask for trust — we show proof.

📈 $TSLA Top Call: View here

📉 $TSLA Bottom Call: View here

Our system predicted these exact moves using this same 5-rule process.

Final Thoughts

The goal isn’t to chase green candles or catch every move.

It’s to build a repeatable process that wins over time — like a hedge fund.

If this framework helped you see charts differently,

you’ll love the full strategy breakdowns, videos, and live alerts inside our free Telegram.

👉 Join here: https://t.me/BearInsights

And if you’re ready to take it further,

explore Omega AI, the app that helps traders beat the market using data, not hope.